Knowing how a check deposit works is essential when you are paid with a check or grandma gives you that birthday check. Personal checks and business checks should be deposited or cashed right away. There are different ways to put your money into a checking account, from a mobile check deposit to an ATM deposit. Make sure you know your options.

Deposit Using Bank’s Mobile App

Video of the Day

Using a mobile banking app is a convenient and safe way to deposit checks through online banking. You can deposit an endorsed check into your checking account or savings account. In addition, most financial institutions' mobile check deposit app is easy to use.

Video of the Day

First, enroll in and download your financial institution's mobile banking app to use your smart device. Then, open up the app and select deposit. It will ask whether you want to deposit your paper check into your savings account or checking account.

Make sure you're using an endorsed check. You can do this by signing your name or the words "for deposit only" on the back of the check. There will be a line for you to sign on the left side of the back of the check.

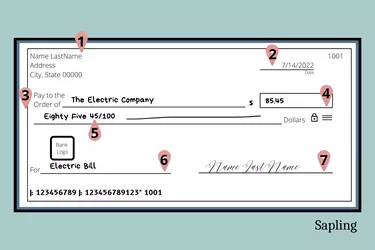

You'll need to enter the amount of the check into the mobile banking app. You will find this number in the dollar amount box (image item 4).

Next, enter the check images. You'll do this by taking a photo of the front of the check. Then turn the check over and take a picture of the back of your check. Make sure the entire check is visible and the images are clear. Then follow the instructions to upload the images.

Funds availability will commonly be the next business day. In addition, some banks have a monthly amount limit you can deposit per month. For example, Bank of America's FAQs states that they have a monthly amount limit. So, check with your financial institution for possible limits.

Personal checks and business checks should be deposited or cashed right away.

Deposit Check at Bank Branch

You'll need a deposit slip if you want to deposit funds at a credit union or bank branch. You'll find a deposit slip in the back of your checkbook. There's a separate deposit slip for a checking account and savings account. But the bank will have deposit slips available if you need one.

You'll need to have your account number. It is printed on the deposit slip in your checkbook. But if you must fill a blank one out, you can find your account number for your checking account at the bottom of the front of one of your checks, just below the memo line (image item 6). It is the second group of numbers. The group of numbers is the routing number, account number and then the check number. A colon separates each set of numbers.

You'll need to put the deposit amount on the deposit slip. But once you have endorsed the check and filled out the deposit slip, you just need to give both to the teller. Although there may be some funds availability that same day, most banks make funds available the next business day.

ATM Check Deposit

You can deposit a check into your checking account or savings account through an ATM. First, you'll need your ATM card. Try to use your own credit union or bank's ATM so you won't have to pay fees. Insert your ATM card, then select deposit. You'll also need to choose the bank account in which you want the money deposited.

Enter the amount of the check. With some ATMs, the check is read, and you won't have to type in the amount of the check. Some banks require a specific bank envelope, and others will let you insert only the check. Make sure you are inserting an endorsed check. It must have your name on the back of the check or the words "for deposit only."