While prepaid cards and direct deposits are very common for receiving funds, you may still get a paper check that you need to cash. Luckily, you can easily cash your check through your own bank or turn to other options like retail stores, check-cashing stores or check-cashing apps. Before proceeding, you'll want to make sure the check is valid, determine any fees and requirements and properly endorse the check. The actual cashing process is usually as simple as presenting the endorsed check with an ID to receive your cash.

Preparing to Cash Your Check

Video of the Day

You'll first want to ensure that the check isn't expired since the type of check determines how long it's valid; this is usually six months for personal checks and payroll checks unless there's a sooner "void by" date, while government checks could be valid for six to 12 months. Cashier's checks, on the other hand, may not expire.

Video of the Day

The actual cashing process is usually as simple as presenting the endorsed check with an ID to receive your cash

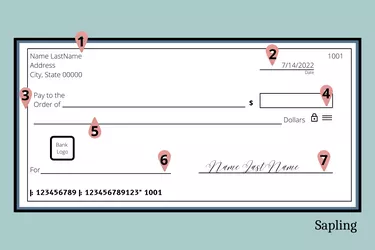

Next, the name or names in the "Pay to the Order of" line (image item 3) must match the photo IDs presented. Whether it is a single- or two-party check will determine endorsement requirements for the endorsement area on the back of the check. Both payees need to sign if the word "and" joins their names, while only one needs to endorse if "or" separates the names. In any case, the endorsement needs to be made before you hand over the check for cashing.

Lastly, know that it's common to need to present identification to cash a check and that you need to check fees and requirements. For example, some locations only cash certain types of checks or limit the amounts. Check-cashing fees usually occur when you don't use your own bank for the service.

Cashing Checks at Financial Institutions

A simple and free option involves going to the bank or credit union where you have a savings account or checking account and cashing the check. However, the CFPB says that other institutions – especially the issuing bank – may help you out and charge a fee.

You'll take the endorsed check and your photo ID either to a teller inside the branch or at the drive-through for cashing. The bank may request your debit card or other proof to verify you're an account holder qualifying for free check cashing.

You'll also need a deposit slip if you want to put any part of the check amount in your bank account at the institution. This slip asks for your name, date, account number, signature, list of items to deposit and any cash to receive.

Cashing Checks at Other Locations

If you lack a banking relationship or just want another option, you can try retailers with paid check-cashing services like grocery stores as well as check-cashing stores. You can generally expect the highest fees at check-cashing stores, so consider these a last resort.

For example, Walmart says that you can simply take the endorsed check and your driver's license to the front desk. You'll pay a max fee of $4 for a $1,000 check and $8 for larger checks. Check limits range from $200 for two-party personal checks to $5,000 for other types, although they boost the latter limit to $7,500 during tax season.

You could also visit the Ace Cash Express with your check and ID and pay a fee based on a percentage of the check amount. Ace Cash Express says that it accepts large checks and most check types, and your check will go through an approval process.

Considering Check-Cashing Apps

If you don't mind not having immediate cash in hand, you can use apps to conveniently deposit checks from home. You can often do this directly through your bank's mobile app and deposit the money into a linked bank account. Many banks – such as Chase – don't even charge a fee.

Otherwise, you can use apps like PayPal and Ingo Money. For example, Ingo Money allows check deposits of up to $5,000 and can send funds to your PayPal, bank account or debit/credit card. Check-cashing fees usually start at $5 for Ingo Money, though it costs nothing if you don't mind a 10-day wait.

In any case, you can expect to take photos of the front and back of your endorsed check and answer questions about the check and where to deposit it. You may need to put "for deposit only" under your endorsement as well, notes Bank of America®.

- Consumer Financial Protection Bureau: Can I Cash a Check at Any Bank or Credit Union?

- Walmart: Check Cashing

- Ace Cash Express: The ACE Cash Express Check Cashing Process

- Ingo Money App: Home

- Huntington: How to Deposit or Cash a Check at the Bank

- Huntington: How Long Is a Check Good For: Do Checks Expire?

- Consumer Financial Protection Bureau: I Received a Check Payable to Both My Spouse and Myself. Do Both of Us Have to Sign the Back of the Check?