You're given a checkbook and checks to use when you first open a bank account with a bank or a credit union, although the initial checks you receive might be just a few "starters." They're a courtesy or "thank you" for using that institution to handle your money. You'll typically be charged if you want to order more checks for your account after you use up those first ones.

You can write a check in any denomination to any payee as long as you have the funds in your bank account to cover the amount of the check. And writing a check the good, old-fashioned way doesn't have to be a challenge.

Video of the Day

Video of the Day

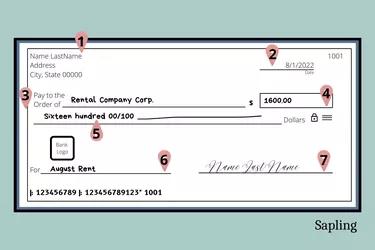

How to Fill Out a Check

A check is just a form that you complete when you want to transfer funds from your account to a payee – the person or business you want to receive your payment. But a check can't be deposited into the payee's account or cashed if it's not correctly written and completed.

Writing checks isn't a challenge, even the first time you do so, because most areas on the check are clearly marked. The check will tell you exactly what information you should enter, but you have to enter the information correctly.

Enter the Current Date

Providing the correct information begins with entering the current date. Write it on the line provided at the upper right corner of your check (2 on the image). The space should be clearly titled, "Date." You can spell it out, or you can use numbers and slashes, according to The Mint: August 1, 2022 or 08/01/2022.

Take care not to postdate the check, using a date in the future, because that could potentially cause problems. The Office of the Comptroller of the Currency indicates that banks are legally permitted to cash or deposit a check before the date entered unless you specifically tell them not to by submitting a form, but the bank employee might not realize this so it could cause an unwanted, troublesome delay.

The “Pay to the Order Of” Line

The next line begins with the words, "Pay to the order of" (3 on the image). This is where you write the full, legal name of the person or business to whom you're making payment.

Enter the Dollar Amount...Twice

Enter the dollar amount of the check in numeric form in the dollar box that appears to the right side of the "pay to the order of" line (4 on the image). Use numerals in this section. You would write "1,600.00" if you're writing a check for $1,600. Break up the number you're entering with commas where necessary. Include the decimal point as well and the correct cents amount after it. There's no need to write your own dollar sign because one is printed at the front of the dollar box.

Next, write out the amount of the check in words and in full on the following line (5 on the image). For example, you would write "sixteen hundred zero dollars" or "one thousand six hundred dollars."

Write "and XX/100" after the dollar amount to indicate any number of cents on your check. Cents are stated as a fraction of 100 because 100 cents make up a dollar, according to Annuity.org. So, 99 cents would appear as 99/100.

The Memo Line

This area can guide you and/or your payee as to what the check is paying for. It can be helpful in the event of dispute, or if you're writing checks for accounts that aren't in your name. Maybe your electric service is in your parent's name. You might enter "Account #XYZ Name of John Doe" on the memo line (6 on the image) to make it clear to the electric company what account the money should be applied to.

Or maybe you have to write a check at your local florist. You might enter "Mary's birthday" on the memo line to trigger your memory as to what the expenditure was for when you look at your checking account statement and canceled check a month or so later.

Sign the Check

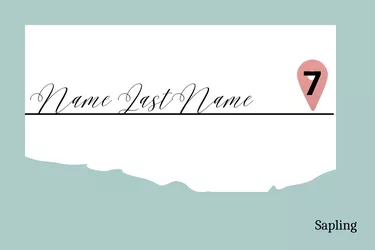

Sign your check on the line at the bottom right corner of the check (7 on the image). This may be the most critical part of all because your check is just a worthless piece of paper unless and until you sign it.