In the United States, all banks have a tracking number, more commonly known as a routing transit number, which helps to make the transfer of money between banks simpler. Routing numbers were started by the American Bankers Association in 1910. All transit numbers are nine-digit numbers that identify your bank when someone cashes or deposits a check you wrote or when you wish to receive an ACH transfer or direct deposit. The number is printed on the check and easy to spot.

Step 1

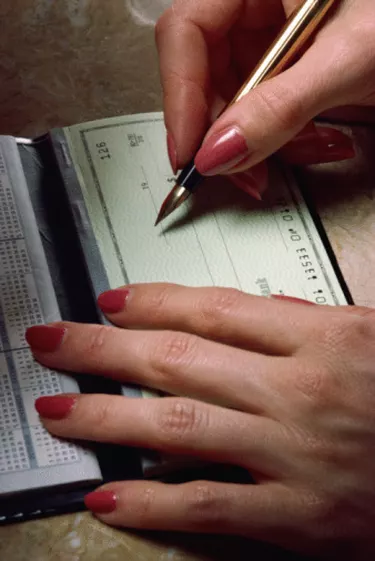

Look for the symbol that resembles "|:" on the bottom left corner of a check. Be sure that you're looking at a check and not a deposit slip, which are sometimes included in the back of a checkbook.

Video of the Day

Step 2

Look to the right of the "|:" symbol. There will be a string of nine digits. That is the routing or transit number. At the end of the string of digits will be another "|:" symbol to let you know that the routing number is finished.

Step 3

Look along the bottom of the check if the nine-digit number is not in the left corner. Some banks print the number in the middle of the bottom. It will always be between two "|:" symbols.

Tip

The string of numbers that appears next to the transit number is usually your bank account number, followed by the check number.

Video of the Day