It's not uncommon for new renters to ask, "Do apartments go on your credit report?" Traditionally, apartment companies have not reported tenant leases, missed payments or other information to the three reporting agencies. However, more landlords are beginning to report, according to Credit.com. If you skip out on your lease, that information might end up on your credit reports.

If you have problems with your landlord, you might end up in court, but your credit report often won't be affected. If you have a good rental history and would like the information to show up on your credit reports, there are steps you can take to do that.

Video of the Day

Video of the Day

Read More: How to Remove Negative Items From Credit Reports

What are Credit Reports?

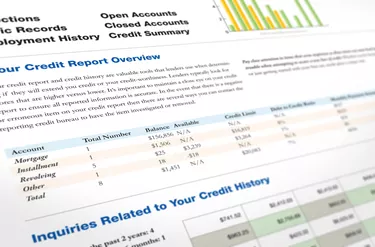

In order to get businesses to lend you money or give you credit, they need to know you're a reliable borrower. They can determine this by looking at your credit use history. Using a credit report from one of the three credit-reporting agencies (Equifax, Experian and TransUnion), landlords and other businesses can check your creditworthiness.

The credit reporting agency gets your information from creditors, who provide them with customer information in exchange for getting access to people's credit reports. Your credit reports show your credit product history, current balances, missed payments and any bankruptcies, collections or debt consolidations you've had.

Read More: Requirements to Rent an Apartment

Why Don’t Landlords Report?

Landlords don't lend you money, so they aren't creditors. For this reason, most don't report to the credit bureaus. Apartment companies still want to know if you are financially responsible, however, so they pay to use the credit agency services.

If You Skip Out

One way your apartment information can appear on a credit report is if you don't pay your rent and your landlord turns your account over to a collections agency. The landlord takes a small percentage of what you owe and the collection agency tries to get the full amount from you, making a profit.

Collections are reported to the credit bureau and can significantly damage your credit history and lower your score.

To see what might happen if you leave your apartment with more damage than your deposit, break your lease early or have other problems, check your lease to see if you agreed to arbitration or other legal proceedings in the event of a dispute with your landlord.

Getting Credit for Rental History

If you'd like to get your good rental history on your credit report, contact your landlord or landlords and ask them if they would report your payment history to one or more of the credit bureaus, recommends Experian. You might be able to use a third-party service to do this.

If you'd like to see if any of your rental history appears on any of your credit reports, visit AnnualCreditReport.com to get free copies of your credit reports. This is the official government-authorized website to get your reports free, once per year. You can also get them free by contacting each of the three credit bureaus. You can get your reports more often by purchasing access at the websites or using a third-party provider.