There are few occurrences more discouraging than the discovery that a collection agency is after you for an alleged unpaid debt. What can be even more alarming is the fact that this collection agency removed money from your bank account in an effort to secure payment. While this may seem unjust, especially when you have other bills to pay, there are situations where it is perfectly legal.

Collection Agency

Video of the Day

It's important to understand that the purpose of a collection agency is to collect unpaid debts. Typically, this is on behalf of your original creditor, who hires the collection agency to do the dirty work. You may also see attorneys who specialize in collection law working to collect debts for their clients. Another possibility is that the collection agency purchased a number of unpaid debts at low cost and is attempting to collect on them for its own profit.

Video of the Day

Legality

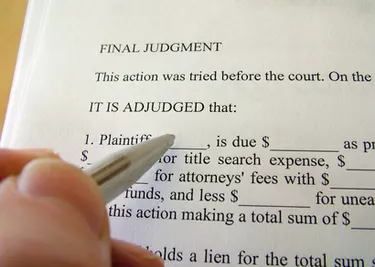

Under Federal Law, a collection agency or debt collector can only withdraw money from your bank account if it obtains a judgment against you. According to Section 809 of the Fair Debt Collection Practices Act, the collection agency must first give you 30 days, through written notice to take care of the debt. Following the 30 days, the collection agency must file a lawsuit and the court must rule in its favor, placing a judgment against you. Then, and only then, can the collection agency place a garnishment on your bank account. The garnishment process varies from state to state.

Exemptions

Most government benefits in your bank account are exempt from garnishment including: social security benefits, Supplement Security Income benefits, federal retirement and disability benefits, federal student assistance loans, military annuities and survivors' benefits, and veteran's benefits. Additionally, child support payments, life insurance benefits and workers compensation benefits are exempt from garnishment. However, it's important to note that collection companies may garnish these funds if the purpose is to pay delinquent taxes, back child support, alimony or for paying back student loans.

Considerations

While it is rare, there may be occasions when a collection agency unjustly takes money from your bank account. If it is due to garnishment of exempt funds, you may need to hire an attorney to assist you in "quashing" -- releasing -- the garnishment. In the very least, you need to provide proof to the court that the funds in your account are exempt.

If the unjust garnishment of your account is because the collection agency does not have a court judgment against you, then you can file a lawsuit. You must do so within a year from the date the agency garnished your account. If the court finds in your favor, you may receive reimbursement of the funds as well as up to $1,000 or more in damages, attorney fees and court costs. However, you will still owe the money on the unpaid debt.