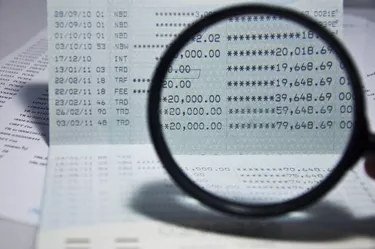

Net income is take-home pay, or the amount a worker receives after the employer withholds amounts for taxes and other deductions. Taxable income is the amount of a person's income that is taxed after deductions are applied to gross income.

Net Income Basics

Video of the Day

Net income is the result of an employer projecting deductions based on what an employee reports on a W-4 tax form. Amounts are withheld from gross income for federal and state taxes, Medicare and Social Security. Additional deductions may include health care premiums, retirement allocations and child care. The remainder is provided to an employee according to the company pay schedule.

Video of the Day

Taxable Income Basics

The Internal Revenue Service and many states use taxable income to calculate how much you owe. It is determined by subtracting certain items from gross income to derive adjusted gross income, and then subtracting tax deductions. Moving expenses and student loan interest are among the items removed from gross income to compute AGI. Tax filers then choose between a standard deduction allowed by the IRS, or itemized deductions for expenses such as mortgage interest and property taxes. Whichever amount is bigger typically allows the filer to report the lowest taxable income.