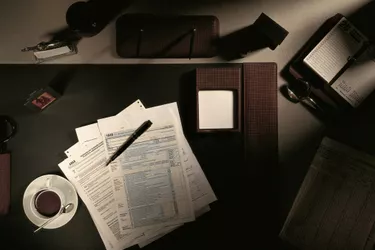

A fiduciary files Form 56 to notify the IRS about any changes in a fiduciary relationship. This form changes the estate's notification address to the fiduciary's address so federal agencies and creditors can send mail regarding the estate to the fiduciary. The form's main purpose is to establish that the fiduciary is responsible for the accounts of the estate.

IRS Form 56 for Estates

Video of the Day

Filing Form 56 is mandatory for the guardian, trustee, administrator or other person who is responsible for a decedent's estate. This person is called a fiduciary, which means they are managing assets that belong to another person or organization. Fiduciary duties appear in a range of relationships, and estate arrangements are the most common type.

Video of the Day

In the administration of estates, the fiduciary must file Form 56 at both the start and the end of the relationship, and also whenever the fiduciary relationship changes.

A single Form 56 only establishes a relationship between a single trustee and a single estate. If there are multiple trustees and one estate, each trustee files the form; and if there are multiple estates and one trustee, the trustee files a form for each estate. An estate trustee must specify whether the decedent had a valid will and list the date the decedent died.

Consider also: Who Must File Income Taxes?

Form 56 and Bankruptcy

A trustee in bankruptcy is another type of fiduciary, since this person is in a position of confidence acting on behalf of debtor. This means that a bankruptcy trustee, an assignee or receiver should also file Form 56.

According to the Internal Revenue Service, filing this form shows that the trustee is qualified to manage the debtor's assets. The trustee must include the date that the court assigned the assets on Form 56. The trustee can file Form 56 for a bankrupt company or a bankrupt individual.

Fiduciary Supplemental Forms

When a fiduciary files Form 56 to cancel the relationship, the fiduciary is still responsible for paying federal and state taxes on the estate. This includes income taxes, gift taxes and estate taxes, and may include tax liabilities in future years.

According to the Internal Revenue Service, the fiduciary can file Form 4810, which asks the Internal Revenue Service to calculate and quickly assess all future years' taxes on the estate. A cautious fiduciary will wait for the assessment before making any distributions to beneficiaries so they are never in the position of having to ask beneficiaries to hand money back to pay back taxes.

The fiduciary can also file Form 5495 to remove any future responsibility to pay debts that the estate incurs. Filing Form 4810 or Form 5495 is optional.

Failed Bank Forms

A less-common form is the 56F. The purpose of filing Form 56F is when the Federal Deposit Insurance Corporation or another federal financial agency takes over a failed bank. According to the Internal Revenue Service, if the agency becomes the fiduciary before the other bank becomes insolvent, the agency has to file Form 56F again. The agency has to file Form 56F every year that it manages the assets of the failed bank.