Bank accounts are private accounts used by banks to store funds for a particular entity, such as a business or individual. These accounts do not physically exist in the same way that safety deposit boxes do, and banks actually use the money in accounts for their own investment purposes while keeping track of the account balance and interest rates.

Transaction Accounts

Video of the Day

Transaction accounts are the most common type of bank accounts used by individuals and businesses. These accounts may also be known as checking accounts as they come with check cards and checkbooks that allow users to withdraw money whenever they need to. Banks create these accounts for accessibility: there are no withdrawal limits, and very rarely any interest rates that allow the account to collect money over time.

Video of the Day

Joint Accounts

Joint accounts are typically transaction or savings accounts, but with a particular twist: they belong to more than one account holder. This allows either account holder to access the account whenever they need to. Users can add and withdraw money independent of each other as they see fit. Banks create this type of account to help support partners and families.

Savings Accounts

Savings accounts are designed to help people keep their funds in a secure account where they can build a reliable amount of interest. Interest rates are low compared to other investments, but the money is Federal Deposit Insurance Corporation insured, and users can switch the funds to another account when necessary.

Investment Accounts

Investment accounts are special bank accounts set up to allow people to invest money at a higher rate than a typical savings account. For some types of investment accounts, banks invest the money in a mutual fund. For other accounts, banks promise a higher interest rate but do not let users access the money for months at a time.

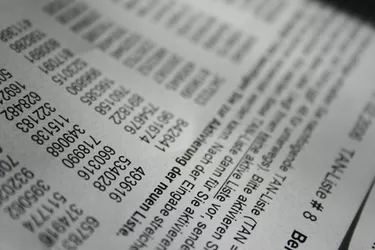

Numbered Accounts

All bank accounts have identification numbers, but numbered accounts are a specific type of account that banks create for privacy. These accounts have security measures in place that make it very difficult for anyone else to access any funds within the account. Instead of using customer names or private information, the account is identified only by a security code.