As well as being personally rewarding, making a donation to charity can be financially advantageous at tax time. As long as you itemize your deductions when you file your taxes (rather than taking the standard deduction), charitable donations made to a tax-exempt organization will qualify as tax-deductible expenses. Claiming such deductions will reduce your taxable income, thus lowering your tax bill.

Step 1

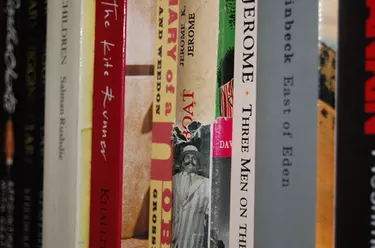

Check the condition of all books you intend to donate, making sure none of them have missing or defaced pages and covers. The idea is to donate books to an organization that can make good use of them or sell them. Further, the IRS stipulates donated items need to be in good used condition or better. Badly damaged or incomplete books are unlikely to sell, and their value is negligible.

Video of the Day

Step 2

Calculate the total fair market value of your books. As far as the IRS is concerned, fair market value is considered to be the price a buyer is willing to pay a seller when neither party has to buy or sell, and when both parties are aware of the conditions of the sale. For further details on this, refer to IRS Pub. 561. If the fair market value of all your non-cash contributions is more than $500, you will also have to file IRS Form 8283 (Noncash Charitable Contributions) with your return.

Step 3

Take your books to your local library and let them know you'd like to make a charitable donation. Some of the more desirable book titles may end up on the library shelves, while others may be sold at one of the library's periodic bookfairs. As with all tax matters, keeping accurate tax records is a must, so be sure to ask the library for an itemized receipt for the books so you have written documentation regarding the fair market value of the donation for your tax records.

Step 4

Enter the total amount of your charitable donation on line 17 of the IRS Schedule A form you use to claim all of your itemized deductions. Remember that if the total of your charitable donations is more than $250, you'll need a bank record, payroll deduction record or some sort of written acknowledgement of the donation from the charitable organization. It's important to keep detailed records of your contribution, since you'll have to substantiate the tax deduction in the event of an IRS audit.

Tip

If your donation is large and you calculate the value to be more than $5000, you'll need to get a professional appraisal in order to claim a tax deduction. The appraisal should be documented in section B of IRS form 8283, which will also need to be signed by both a representative of the charity, and the appraiser. If your library declines your offer of donating the books, or if you decide to take them to a Goodwill or other non-profit store, take the time to visit the store first and make a note of their sticker prices on similar books. This will help you establish a reasonable fair market value of your books.

Warning

Remember that unless a book title is highly desirable, its fair market value is always far less than its retail price, so don't make the mistake of basing your deduction amount on the retail prices of your books. Not all organizations qualify for this tax deduction. For an up-to-date list, check IRS Publication 78.

Video of the Day