With the ease of access we have to our bank accounts and credit cards, it's easy to lose track of how much money we've spent. You can easily check your account balance online, over the phone, via an ATM or in person by visiting your financial institution. However, that figure may not always be accurate because you might have pending transactions that have not yet posted to your account. Failing to keep an accurate tab on your account balance could cause you to overdraw your account, resulting in costly fees or declined transactions.

Tracking Your Transactions

Video of the Day

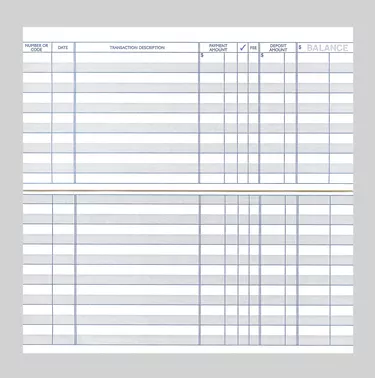

The best way to keep track of your available funds is by recording each transaction in a checkbook register, notebook or spreadsheet as soon as you make it. To begin calculating your balance, enter the current balance that is posted to your account. Next, record pending transactions such as pre-authorized debits, recurring automated bill payments and checks that have been written but not yet cashed. As you continue to use your account, deduct purchases from your balance and add deposits as they occur. This method takes the guesswork out of keeping up with your purchases and ensures you are always aware of the exact dollar amount of your available account balance.

Video of the Day