Yield to maturity is an important concept for bond investors. The yield to maturity (YTM) is the rate of return an investor would earn on a bond that was purchased today and held until maturity. In the bond pricing equation, YTM is the interest rate that makes the discounted future cash flows equal to the current market price of the bond.

General Process

Video of the Day

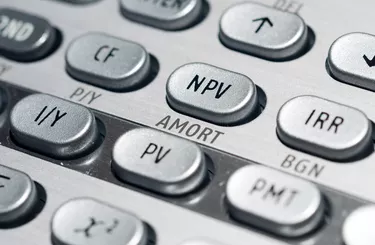

Solving the mathematical formula for YTM is cumbersome and difficult, but the calculation is simple with a financial calculator. Information about the current price, face value, years to maturity, and coupon rate or coupon payment are entered into the calculator's time value of money functions. Solving for the interest rate provides the yield to maturity.

Video of the Day

Example

Consider a bond selling for $857 (PV) with a semi-annual coupon payment of $25 (PMT), a $1,000 face value (FV), and 20 semi-annual periods (N) until maturity. Calculate the yield to maturity for this bond using the time value of money keys on a financial calculator and solving for the interest rate (I) of 3.507%. In this case, the interest rate is the semi-annual rate and can be multiplied by two for an annual rate of 7.01%.