While most individuals and business owners purchase insurance to cover specific losses, they often do not consider indirect loss. This type of loss can significantly impact personal or business finances.

Definition

Video of the Day

Indirect loss is an expense caused by damage or injury to covered people or property, which is beyond the scope of the covered damage. This expense is attributable to the covered loss, but is not part of the covered loss itself.

Video of the Day

Example

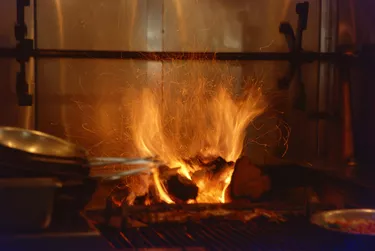

If a restaurant's oven catches fire and sustains damage, that damage is a direct loss. If smoke from the fire damages the restaurant, causing operations to cease for weeks, the loss of business revenue is an indirect loss.

Coverage

Most insurance policies do not provide coverage for indirect losses.

Finding Coverage

Some companies offer endorsements or separate policies to cover indirect losses for an additional premium. Be sure that the policy covers any type of indirect loss caused by damage to the covered person or property.

Insurable Risk

An indirect loss policy will only cover insurable risks, which are those attributable to damage to insured people or property. Losses caused by outside forces such as economic downturns are not insurable.