Every plot of land within a county or other local jurisdiction has a unique, multiple-digit identification number assigned by the county tax assessor or other local government office.

The number, known as a property parcel number, serves to identify land according to the property lines for tax purposes only, and is not part of the land's legal description. Depending on your location, tax officials may refer to it as a parcel number, a property index number or an assessor's parcel number.

Video of the Day

Video of the Day

Because parcel numbers and property records are public, most counties offer multiple ways for homeowners, property appraisers or property owners to find this information. Make sure you know the correct street address as well as the owner's name before beginning your property assessment research.

1. Check prior year tax statement

Look for the number on a previous tax year's statement or a property tax revaluation notice. The number will likely be in the tax information section, usually at the top of the bill.

2. Contact your Lender

Contact your lender if property taxes are included in your mortgage payment and you either can't find or didn't get a copy of the property tax bill to your correct mailing address.

3. Check the Listing Sheet

Check for the number on the property's listing sheet, in the tax section of the title report, or on the property deed.

4. Ask your real estate agent

Ask your real estate agent for the property information or the parcel map.

5. Search Government Sites

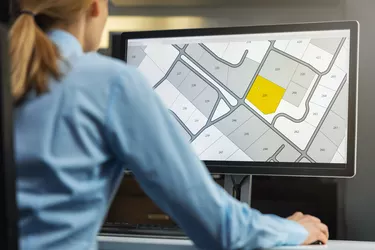

Search for the number online. County government websites usually have property search tools, including maps and searchable databases that require only the property address to search for parcel information.

Bonus Tips

If you can't find your county assessor's office website, look for it on your state Department of Revenue website.

Visit the tax assessor's office in person. Some offices have self-service computers where you can look up the number. Staff members can also provide assistance.