There are three main credit reporting agencies: TransUnion, Equifax and Experian. These bureaus use two basic types of reporting codes---account codes and comment codes. Each credit bureau has a set of response codes that are sent to First American CREDCO with a credit score response. One or more factors are then sent out that explain the factors used to determine the score. An error code means CREDCO could not determine the score.

How a Credit Report Looks

Video of the Day

A credit report is divided into four basic sections: identifying information, credit history, public records and inquiries. Other types of information may include your current and prior addresses, date of birth, telephone numbers, your driver's license number, the name of your current employer, and your spouse's name. The account information will include the name of the creditor, the account number of the trade line and other information, such as when the account was opened and any other name or names on the account, as well as what are the limits and balances due.

Video of the Day

Code Translations

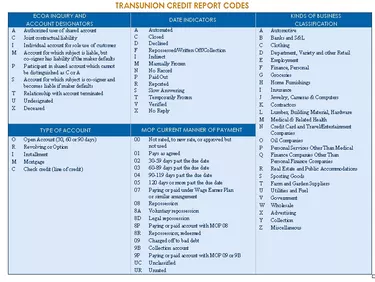

Payment codes range from 1 to 9 and use the letters "R" for revolving, and "I" for installment. An R1 or I1 is an indication of a good payment history. A credit report code of zero means that there is nothing to rate or the account is too new; 1 means paid as agreed; 2 means up to 59 days past due; 3 means more than 60 days, but less than 90 days past due; and 5 means the account is more than 120 days past due.

Other Account Codes

Besides revolving or installment accounts, there are three other types of accounts: Open (O), Mortgage (M) or Line of Credit (C). Letters are also used to designate other types of account definitions, such as those under Inquiries (who looked into your account, though it does not state the purpose), Date Indicators (whether or not it was paid out, closed, declined, etc.) and Kind of Business (owed)--whether the debt was or is owed to an automotive company, a bank or a clothing store; or if it was medical, for insurance purposes, etc.

What is a Charged-off Account?

"Charged off" means the creditor has not received payment and does not expect to in the near future. Collection efforts have resulted in a no-pay and they have written it off. A write-off does not mean you no longer owe it, but simply that the company or creditor is no longer holding it in their accounts receivable queue. By the time this happens, it is usually with a collections agency that will continue efforts to get payment somehow unless the debtor files for bankruptcy.

What is a FICO Score?

Fair, Isaac and Co. (Fico) is the creator of the FICO score, a widely-used credit scoring model that determines a person's creditworthiness or liabilities (risk). You will have three FICO scores, one from each of the Big Three agencies noted above. The three scores are calculated as an average from a minimum of one account that has been open or updated for at least six months. This assures the person looking at your report that there is enough recent information on which to base a FICO score.