A company's financial statements are supposed to provide a picture of its financial condition. But without context, the statements are just numbers -- a muddy picture, at best. Detailed disclosures contained within the footnotes to the financial statements supply the necessary context, fleshing out the picture for investors, analysts and regulators.

Four Financial Statements

Video of the Day

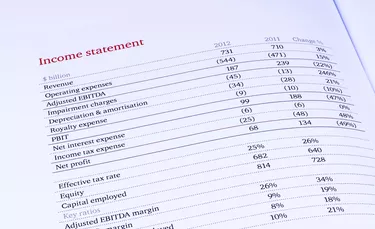

Companies produce four basic financial statements: the balance sheet, income statement, cash flow statement and equity statement. The balance sheet lists the company's assets and liabilities and provides a snapshot of the company's financial condition. The income statement identifies the company's revenue and expenses over a specific period of time and tells you whether the firm made or lost money. The cash flow statement traces cash coming into and going out of the company. The equity statement provides details about the owners' stake in the company, be they partners, shareholders or members of an LLC.

Video of the Day

Importance of Footnotes

Each financial statement comes with footnotes, which provide explanatory details, or disclosures, about the information presented on the statement. For example, a company's balance sheet might say the firm has $2 million worth of long-term debt. The footnotes then disclose how that debt is structured, what kind of interest the company is paying and when the debt is to be paid off. Footnotes are not superfluous information or legalistic fine print. They are an integral element of the statement itself. These disclosures provide essential context for understanding the statement, and investors and analysts pore over the footnotes for insight on the company's operations.

Requirements for Disclosures

Many disclosures are mandatory under accounting standards -- known in the United States as generally accepted accounting principles, or GAAP -- or required by the Securities and Exchange Commission, which regulates public companies. Others are left to the company's discretion. Some disclosures are considered important enough that they must be included on the face of the statement -- the main page, where the most important information is displayed -- while others must appear only in the footnotes. As accounting standards have become more complex, some companies' footnotes have grown to include hundreds or even thousands of disclosures. That's led to fears in the accounting profession of information overload, as well as discussions among accountants and regulators about ways to streamline disclosure requirements.

Types of Information

Some disclosures are broad in their implications and provide fundamental details about how a company handles its finances, such as its criteria for recognizing revenue and expenses. Others are narrower, providing context for a single number in a statement. Many disclosures focus on risk and uncertainty -- how much of accounts receivable is likely to go uncollected, for example, or how many warranty claims it expects to have to handle.