Day trading can be a profitable venture, but it requires in-depth knowledge of investment strategies. First, you need to learn the basics and then research the best trading platforms for beginners. Second, it's important to have a strong understanding of the financial markets and portfolio management. With that being said, take these steps to start a day trading business without losing your money.

Tip

The first step to starting a day trading business is to learn about the financial markets and practice your skills. Choose a trading platform for beginners and set up a demo account before investing real money.

Video of the Day

Learn the Ropes

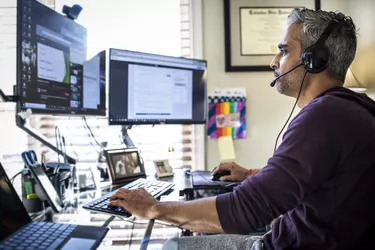

The internet is flooded with stories about successful day traders and their laid-back lifestyles. But nothing could be further from the truth. Day trading carries a high degree of risk and takes significant effort. Those who pursue this path often spend hours in front of the computer, researching the market and testing different strategies. Their job requires extensive experience, knowledge and some luck.

Video of the Day

If you're just getting started, make sure you understand how day trading works and how to mitigate the risks. As the U.S. Securities and Exchange Commission points out, this practice can result in substantial financial losses in a short time. Day traders buy and sell stocks, exchange-traded funds (ETFs) or other securities within the same day. Therefore, they must act quickly and know the market inside out. About 72 to 80 percent end up losing money, reports a 2017 review published by the University of California, Berkeley.

Day trading books and financial charts may help to some extent, but you also need to conduct market research and practice your skills. Determine what you want to trade and then learn the best practices. The Financial Industry Regulatory Authority (FINRA) has some great resources on its website, so be sure to check them out. Beginner day traders must also learn to read stock charts, study actual trades and experiment with short-term strategies, such as scalping, mean reversion and range trading.

Research the Legal Requirements

Day traders are subject to industry-specific regulations, but they must also comply with the legal requirements governing business entities. For example, they must maintain a minimum balance of $25,000 at all times, explains FINRA. If you fail to meet this condition, you won't be allowed to day trade until your account balance reaches that amount. Traders may use a combination of cash and eligible securities to meet the minimum equity requirement.

Another aspect to consider is that day traders are not considered investors. Therefore, they are treated differently from investors at tax time, according to the IRS. For starters, you must choose a business structure, apply for a federal tax ID number, obtain business permits and open a bank account. Things get even more complicated when you hire employees.

Forbes recommends forming an S corporation to maximize your tax benefits. This business structure would allow you to deduct startup costs and other expenses, such as retirement plan contributions, health insurance, officer compensation costs and more. Ideally, discuss your options with an accountant or financial adviser before taking this step.

Consider also: How to Avoid Day Trading Penalties

Join Trading Platforms for Beginners

Once your day trading business is up and running, look for the best investing sites and choose one that matches your skill level. Assess your risk tolerance and determine how much you can afford to lose. To stay on the safe side, start small and learn as you go. If you're a newbie, join trading platforms for beginners and then set up demo accounts. This will allow you to test the platform and practice your skills without losing money.

A good choice is TD Ameritrade, a digital platform that allows users to buy and sell stocks, bonds, ETFs, mutual funds and other securities. It also offers interactive tools and educational resources for beginner traders. There's an entire section featuring market news, investment tips and expert insights from third parties.

You may also register on Fidelity to trade stocks, precious metals, fractional shares and more. Users have access to live webinars, coaching sessions and weekly classes for beginner traders. Webull and TradeStation offer similar features, from stock trading apps to research tools. Interactive Brokers can be a great option too, but it appeals to more experienced traders.

- Office of Investor Education and Advocacy: Day Trading

- University of California, Berkeley: Do Day Traders Rationally Learn About Their Ability?

- Financial Industry Regulatory Authority: For Investors

- Financial Industry Regulatory Authority: Day-Trading Margin Requirements: Know the Rules

- IRS: Topic No. 429 Traders in Securities (Information for Form 1040 or 1040-SR Filers)

- IRS: About Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship)

- Forbes: How to Structure a Trading Business for Significant Tax Savings

- TD Ameritrade: Why TD Ameritrade?