With international travel opportunities expanding with technology, global sales (large and small) transactions made easy via the web and family contacts living or working abroad, it is easy to find yourself with a foreign check. If you need to cash a foreign check and are not sure how, there are several procedural guidelines to follow and useful tips to consider before ever stepping foot in your banking institution.

Step 1

View bank policy to confirm your banking institution will accept and allow account holders to deposit foreign checks.

Video of the Day

Step 2

Deposit the foreign check into your checking or savings account. Many banking institutions require an account holder to maintain a positive balance at the time of the deposit and have a 30- to 45-day history with the banking institution before foreign checks will be cashed.

Step 3

Maintain the monetary value of the foreign check in the U.S. account until 100 percent of the funds are drawn against the issuing foreign bank. If your bank cannot recover the monetary value of the foreign check, you will be held responsible for the value of the check. Additional fees may also apply.

Step 4

Receive a partial payment for the foreign check. Many banks will only release the first $100 dollars of a foreign check, or other specified monetary amount, and hold the remaining funds until the foreign check is cleared. Even if the check is cleared, it may be returned for insufficient funds or fraud if it is not valid.

Step 5

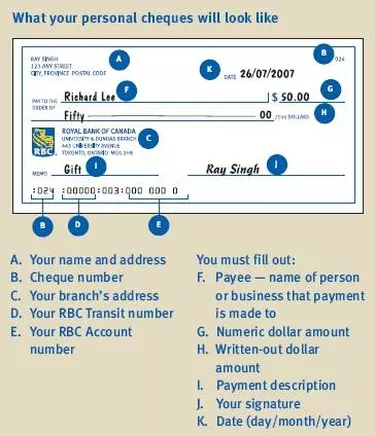

Sign and endorse the foreign check. When depositing the foreign check, write the check number on the back of the deposit slip. The bank will cash the check at the current exchange rate. A processing fee may also be applied at this time depending on bank policy and the value of the foreign check.

Tip

If you hold an account with a parent or affiliate banking institution where the foreign check is issued, you may be able to deposit the foreign check into your U.S. account with a shorter wait period and fewer to no fees.

Warning

Never accept a foreign check from an unknown source.

Video of the Day