When you open a checking account at a bank or credit union, the account is assigned a unique identifier called an account number. This number is printed, along with other numeric codes, at the bottom of each check. The account number tells the bank which account it should take money from to pay the checks you write. Checking account numbers have other uses. For example, if you want an employer to send paychecks to your account electronically via direct deposit, you have to provide the account number.

Dissecting Check Numbers

Video of the Day

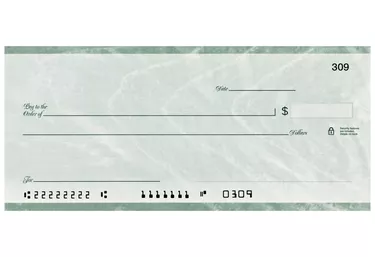

Look at the lower left-hand part of a check and you'll see a long string of digits. The checking account number is embedded in this string. Starting from the left, the first nine digits are the bank's routing number. Routing numbers are assigned by the American Bankers Association and identify the bank that holds your checking account. After the routing number is a non-numeric symbol and then another group of four to 13 digits. This is the checking account number. You'll know when you are at the end of the checking account number when you see another non-numeric symbol. After this symbol is a last group of digits that identify the individual check number; these digits should not be included in the account number.

Video of the Day