Tracking monthly expenses can be as easy as jotting them down as you spend money. However, the easiest and most organized way is to set up a monthly expenses template that you can use each month to keep tabs on your spending. You can tailor several methods of creating a sample expenses template to your needs and use categories that are relevant to your spending patterns.

Step 1

Decide whether you want to create a computerized or a manual template. Your choice should be based on how strong your computer skills are, how complex your budget is and how many expense transactions you are likely to have in a month. Large, complex budgets are easier to maintain in a computerized spreadsheet, such as Microsoft Excel.

Video of the Day

Step 2

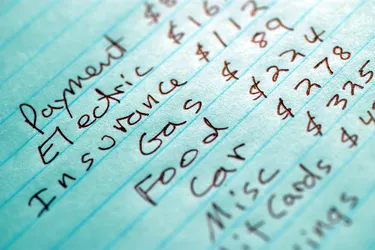

Choose the expense categories to set up. Look at your spending for the past three months by browsing bank statements and purchase receipts. Expense types with the most transactions should be given their own column, while occasional expense types can be lumped together in a column called "Miscellaneous." Common expenses include rent, car payments, utilities, entertainment, medical and donations.

Step 3

Create the columns in the spreadsheet that will represent expense types. In both a computerized and manual spreadsheet, name the first column "date" and the second "description." This allows input of details for each expense in the rows. Each column to the right of this should be titled by an expense type. The last will be titled "Miscellaneous" to capture any expenses that do not fit in other columns.

Step 4

Set up a subtotal row at the bottom of the monthly spreadsheet. If you are using a computerized version, input the formula to sum up all rows in each column. In a manual spreadsheet, draw a line above the subtotal row and a double line below it. Add up the monthly totals in each column at the end of the month.

Step 5

Repeat steps 3 and 4 in new spreadsheets -- one for each month you want to track. It is common to set up all of the expense templates at the beginning of the year for the whole fiscal year.

Tip

At the end of each month, compare your spending in each expense category to your budget to ensure that you are still on point. Choose expense categories that relate to your income taxes. For example, have separate categories for donations, medical expenses and mortgage interest.

Things You'll Need

Bank statements and receipts for past three months

Computer with Microsoft Excel or other spreadsheet program (optional)

Pen and lined paper

Warning

If creating a computerized expense template, take a backup of the file at least monthly and keep it in a different location from the computer. If you lose the file, you can always recreate it from the backup.

Video of the Day