Domestic stocks are the stocks of American companies traded on the various stock exchanges. Foreign stocks are the stocks of companies outside the United States. If their stocks trade on U.S. exchanges, it is through what is known as an American Depository Receipt (ADR). Domestic stocks range from the smallest of public companies to the largest of industrial conglomerates. The largest American stock exchanges are the NASDAQ, the New York Stock Exchange and the American Stock Exchange. Smaller active exchanges also exist in Boston, Chicago, Miami and Philadelphia.

Function

Video of the Day

The function of a domestic stock is to divide the ownership interest of a given company equally among the number of shares outstanding for that company. Every shareholder is a part owner in the company, and their ownership interest is equal to the percentage of shares they own relative to the number of outstanding shares in the company. For example, if a company has 100,000 shares outstanding and Mr. Investor owns 4,300 shares of the company, he owns 4.3 percent of the company. In the case of common stock, another function of domestic stock is to grant voting rights to the shareholders in direct proportion to the number of shares each shareholder owns. In other words, each share of common stock is equal to one vote.

Video of the Day

Types

The three types of domestic stocks are common stock, preferred stock and convertible preferred stock. As the name implies, common stock is the most readily available of the three, and the only type that includes voting rights. Common stock may or may not pay a dividend. Preferred stock gives shareholders some benefits that don't exist in common stock. First, preferred stock almost always pays a dividend. When a company is profitable, preferred shareholders must be paid first. Likewise, when a company goes bankrupt, the assets are divided among the preferred shareholders before the common stock shareholders see a penny. The third type is convertible preferred stock, which acts like a preferred stock in the sense that it pays dividends and gives "front of the line privileges" to its shareholders, but it also has the ability to convert from preferred stock to common stock if and when certain publicly disclosed conditions are met.

Identification

Domestic stocks are identified by their stock symbol. Stock symbols are most commonly three or four letters (depending upon the exchange where the underlying stock is traded), but can sometimes be five letters if they are traded on a conditional basis or in other circumstances. The New York Stock Exchange and the American Stock Exchange use three-letter stock symbols and the NASDAQ uses four-letter stock symbols.

Considerations

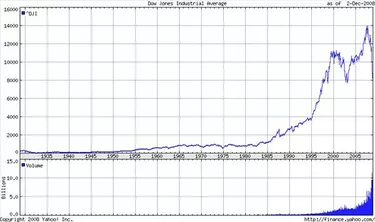

Over time, investing in domestic stocks has provided consistent returns. Since the Great Depression, the trend has been almost exclusively upward.

Warning

Investing in domestic stocks entails risk. It is possible to lose all or a portion of the amount invested. There are no guarantees in the stock market, and investors are not insured against a loss.