A few months ago, I found myself in a pickle: A writing gig I counted on to pay my rent and living expenses slashed my hours in half, and I was about to come up short for my next month's rent. While I do have some savings, I am the kind of person who feels like she's drawing blood when she withdraws from them. So instead of doing that, I "made" some money appear in my life. The next time you're in a little financial pickle, keep these tips in mind:

Return, return, return

Video of the Day

That dress you've had slung over our chair for a week because you aren't sure what to wear it with? Those shoes you tried on at home that don't quite fit? If they're recent purchases and you aren't feeling them, return them. Yes, going to the post office to ship them back might seem like the greatest hassle in the world, but it's nothing compared to holding onto something that you can get all (or at least most) of your money back for.

Video of the Day

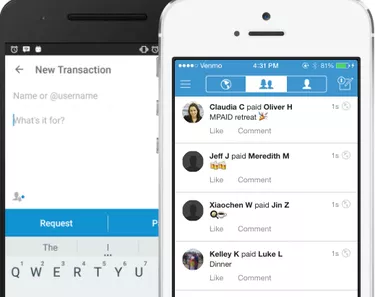

Venmo? Paypal? Check (and withdraw from) your balance

If you use any sort of electronic payment app or service, it can be easy to forget to withdraw the money other people have sent you through them. Every now and then, I'll dip into my Venmo account and see that someone's paid me back for a meal we split, or someone got me back for drinks a few nights ago. You should be getting notifications for every transfer you receive, but all those little transfers (which you might ignore) sometimes add up to be a lot, lot more.

Sell your stuff

If you've missed the return period for something you don't actually intend to keep, SELL IT. There are a few ways to do this:

The Listing: Facebook and Craigslist both have thriving Free & For Sale-esque communities. A quick search on Facebook should bring up some; if you live in a college town, the opportunities to unload some stuff, especially furniture, are generally plentiful around August/September and May/June, but people are always looking to buy things on the cheap. As with all things, use caution when setting up meets to hand off goods, and ask for part of the payment before you make the transaction.

The App: Beyond the Etsy and Ebay marketplaces, which may or may not be something you should consider, apps like Mercari, letgo, and Poshmark offer up more selling options, though you'd need to do a cursory scroll through the apps to see what things are selling at what price points. And if you really need help, people actually offer tutorials on how to post your goods, e.g. this video optimizing how you sell on Mercari.

The In-store: As immortalized in Broad City, consignment stores can be brutal when it comes to their standards for taking in clothes. And, there's the small fact that cashing out often deals up a lot less money than transferring them for in-store credit, aka not real cash. However, if you're already going to be spending your magic money on clothes, shoes, and accessories, this could be a good option — just good luck finding something a store will take.

Cut those coupons

Treating money you've saved as money earned back can be a slippery slope (50% off of a $500 purchase doesn't mean you somehow "made" $250!) but, if you're going to be buying that thing regardless, it doesn't hurt to do the old school one-two of shopping around and looking for specific deals.

Sites like ShopStyle will help you narrow down purchases by need (size, color, price point) so that you can look at a lot of options at once. Google Shopping, which auto-appears if you type in a product name, also helps you see who's listing what things for what price. Keep your eye out for seasonal sales or free shipping shout-outs at your favorite vendors, and it never hurts to Google or do a social media sweep (Facebook and Instagram especially) for special discounts, which is how I once shaved shipping and 15% off of an order.

Pull your loans in

It's a tale as old as time: You lend someone money and it doesn't really matter that they don't pay you back immediately or, uh, within a couple of months, or longer than that. But sometimes the fastest way to get your cash back is by gently reminding your friend or family member that hey, remember that money you lent that one time, which the other person promised they'd pay back? Time to pony up.