A check bounces when a check writer doesn't have enough money in their checking account to cover the amount written on the check. This is called nonsufficient funds (NSF) or insufficient funds. It is also called a bad check. Although a bounced check won't affect a credit score, it will cost money in the form of a bank fee if your bank charges a fee for this.

Nonsufficient Fees Hurt Wallet

Video of the Day

A returned check, or bounced check, is returned to a financial institution because the check writer doesn't have enough money in their bank account to cover the amount on the check.

Video of the Day

When the check recipient tries to cash a personal check with insufficient funds, their bank sends the check to the check writer's financial institution to collect. It bounces back when there are nonsufficient funds to cover the amount on the check. Then, the check recipient is out money.

The check writer's financial institution will charge the check writer a returned check fee. This is also called an NSF fee. This is nonrefundable to the check writer.

The check writer still has to put funds into the bank account to cover the check, but now they also have a bounced check fee. The result is an NSF fee has been added to the expense of writing a check.

On top of this, the check writer now has an angry payee who must redeposit the check and hope it clears this time.

Overdraft Protection Still Costs

Overdraft protection saves a check writer from writing a rubber check. If the check writer has overdraft protection on their checking account, they don't have to worry about a returned check and an angry payee.

The financial institution basically provides a small line of credit and covers the checking of insufficient funds. It doesn't matter what the account balance is, the financial institution will cover it. But this protection comes at a price.

There are overdraft fees associated with overdraft protection. The check writer doesn't have to worry about having enough funds, but overdraft fees are often expensive. Fortunately, some financial institutions are adjusting overdraft fees and nonsufficient funds fees.

Starting in 2022, Bank of America reduced overdraft fees. They also eliminated NSF fees. Although, most credit unions and banks still charge for both; the check writer should contact their financial institution to learn what fees they could incur.

A returned check, or bounced check, is returned to a financial institution because the check writer doesn't have enough money in their bank account to cover the amount on the check.

How to Avoid Bounced Checks

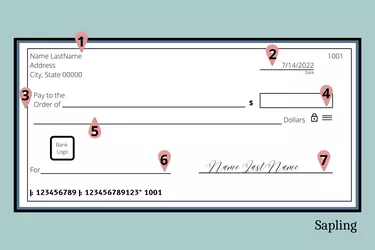

There is a check register in the back of a checkbook. This is where the check writer should record every check written. The date (image item 2), payee (image item 3), amount of the check (image item 4) and memo (image item 6) should be inscribed in the register. In addition, the check writer should keep a running account balance to ensure there are always enough funds in the checking account when writing a personal check.

Using a debit card, when possible, can help avoid bounced checks. In most cases, the card will be denied if there are insufficient funds in the bank account. This will save NSF fees and overdraft fees.

Consequences of Bad Checks

Writing an NSF check is bad personal finance and can have more ramifications than just fees.

Before pulling out that checkbook to write a rubber check, think about the consequences. A check writer could have criminal charges levied against her if a bad check is written. Most state laws call it a misdemeanor to write checks that have insufficient funds. The check recipient has the right to file a civil suit if a check is returned.

Payees will know if the check writer is chronic with writing bad checks. A check writer with this bad habit will be reported to a consumer reporting agency like ChexSystems. When a check recipient like a grocery store or other retail store runs the check, a consumer reporting agency will let them know if the check writer is a high risk.

And although it won't hurt a credit score, the consumer reporting agency makes every financial institution aware. So the check writer might have a problem opening a bank account or getting a loan.