Paper checks have changed over the years, processing faster using smarter technology than in previous decades. While e-checks have grown in popularity, paper check handling has gone digital, as well, with businesses often processing them electronically. To successfully pay for something using a check, it will need to include all the classic check elements, including the payee, the payor's contact information, an amount, a signature, bank account information and the routing number of the bank issuing the funds.

Required Printed Check Information

Video of the Day

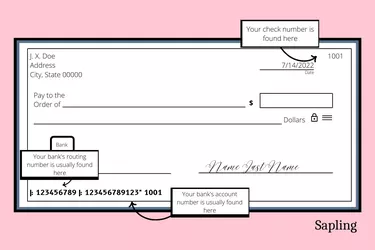

From the printed background to the contact information and bank name, there are preprinted items on business and personal checks that are often scrutinized. If the check looks cheaply printed or certain elements don't appear to have been printed with the check, it could be refused.

Video of the Day

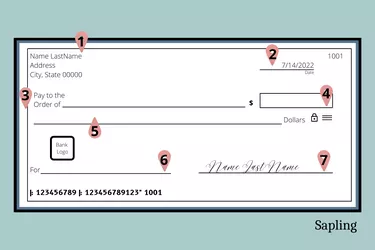

Here are the basic printed elements that should be on every check in your checkbook.

- Payor's contact information: Your contact information information is preprinted on the check (image item 1) and will include your name and street address. A contact phone number is optional.

- Fill-in lines: There should be a preprinted area for the date (image item 2), a "Pay to the Order of" line (image item 3) to fill in a name, a box for the dollar amount (image item 4), a line to write out the amount in words (image item 5) with "Dollars" at the end, a memo line (image item 5) and a line for your signature (image item 7.)

- MICR line: The Magnetic Ink Character Recognition Line, printed at the bottom of the check, is vital to check processing. It should be flat and part of the paper and include, in order, the routing number, checking account number and the check number, which should match the number printed in the top-right corner of the check.

- Bank logo: Every check must have a preprinted financial institution logo. Although the routing number electronically directs the funds to come from the right place, this bank logo assures the recipient that the check is legitimate.

Required Handwritten Check Information

If, like many people, you're used to electronic payments and ATMs for all your banking, writing checks might not be second nature. There are some basic things you'll need to hand-write or print on each check to ensure it will go through without a snag.

- Current date: In Position 1, simply write or print the current date.

- Recipient name: In Position 3, you'll see "Pay to the order of." This is where you write the name of the person or business you're paying. Make sure you get the exact name on the account to avoid issues with the recipient depositing it.

- Dollar amount: In both Position 5 and Position 6, write the exact dollar amount. You can do this as numbers, i.e. $5.46, in Position 5, but you'll need to write it out as such in Position 6: Five and 46/100.

- Signature: Without a signature, your check won't be valid. You'll need to hand-write this in Position 7.

There is a line, seen at Position 6, known as the memo line. Here, you can input information to help you or the recipient. This might include what the payment was for or information like the invoice number.

To successfully pay for something using a check, the check will need to include all the standard check elements, including the payee, the payor's contact information, an amount, a signature, bank account information and the routing number of the bank issuing the funds.

Background Checks Not Required

Whether you're accepting a check that can't be submitted by direct deposit or writing a check of your own, it's important to follow proper protocols to ensure your check will be accepted. It's important to note that checks can be subject to automatic funds transfer, so assuming that you'll have two or three business days to get money in your account is not a good idea.

If you're using a check to pay a business, be prepared to offer some information. The business may log your driver's license number and date of birth. However, it's not a good idea to have this information printed on the check.

If you need help remembering what goes on a check, keeping a canceled check handy to refer to each time you write one can help. Unless you regularly write checks, you may need that refresher each time you pull out your checkbook.